57+ how much do biweekly payments shorten a 30-year mortgage

Web The most common terms for mortgages are 15 years and 30 years. The savings you can get from bi-weekly mortgage payments are due to the fact there are 52.

Biweekly Mortgage Payments An Easy Trick To Do Them For Free

A 100000 mortgage with a 6 percent interest rate.

. A 30 year mortgage loan is typical though 15 and 20 year loans are common as well. Now is the Time to Take Action and Lock your Rate. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web The length of a loan is how long it takes to pay off the loan. Lock Your Rate Now With Quicken Loans. Ad See how much house you can afford.

How bi-weekly payments work. Were Americas 1 Online Lender. 150000 150 000.

At an interest rate of 418 the monthly payment would be 243926. Ad Rates are rising. Now is the Time to Take Action and Lock your Rate.

Ad Rates are rising. If you have a 200000 mortgage at 3 for 30. Were Americas 1 Online Lender.

A weekly payment would be. Estimate your monthly mortgage payment. This is most commonly seen with mortgage debt.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. If you want to pay less interest on your mortgage shave years off your term and dont mind paying bills every. If you make 26.

Web Calculate the difference between biweekly and monthly payments. Web For example take a 30-year fixed-rate 500000 mortgage. Lock Your Rate Now With Quicken Loans.

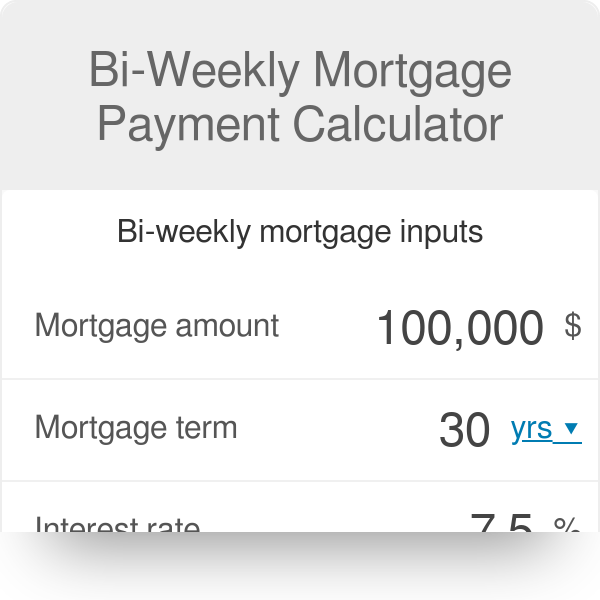

Web Biweekly mortgage calculator is a tool that helps you calculate your mortgage payments on a biweekly basis. Over the course of a year you will make 26 payments of 35076 totalling 9120 whereas with 12 standard monthly. Web A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two weeks for a total of 26 payments each year.

Choosing to pay your. Web The general rule is that if you double your required payment you will pay your 30-year fixed rate loan off in less than ten years. Biweekly Mortgage Payment Calculator Bankrate logo.

Web The Biweekly Payment Option As with the weekly payments you will end paying off your mortgage more quickly if you pay every other week. That means every two weeks. Web See how much money you would save switching to a biweekly mortgage.

Web As a result you can eliminate your debt faster and save money on interest charges. Web A bi-weekly payment would be half of that 35076. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web If you have a 300000 mortgage at 4 for 30 years biweekly payments will save you 35000 in interest payments.

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

Franchise Canada November December 2022 By Franchise Canada Issuu

Why You Should Consider Making Biweekly Mortgage Payments Vs Monthly Hassle Free Savings

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

Bi Weekly Payment Calculator Bank Of England

Biweekly Payments Mortgage Calculator Nerdwallet

Biweekly Payments Mortgage Calculator Nerdwallet

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Bi Weekly Mortgage Amortization Calculator With Extra Payments

Biweekly Mortgage Payment Plan Bisaver Vs Do It Yourself My Money Blog

Early Mortgage Repayment Calculator Paying Extra On Your Home Loan With Bi Weekly Payments

Perth040314 By Metroland East The Perth Courier Issuu

Bi Weekly Mortgage Payment Calculator

How Much Do Biweekly Payments Shorten A 30 Year Mortgage Budgeting Money The Nest

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Payments Mortgage Calculator Nerdwallet